Economic Causality and Investment. Hands-on Approach

This is the accompanying website for the article 'Causality in Economics'.

The Goal

The goal of this website is to provide you with numerical tools for exploring causality in economics and associated time lags. Our approach is model-agnostic, focusing on the application of various Machine Learning techniques. The model is not based on any theories—'Classics,' 'Neo-Classics,' 'Keynesians,' 'Post-Keynesians,' 'Monetarists,' 'Neo-Marxists.' There is no Cobb-Douglas production function, Taylor rule, or Philips curve in the foundation of the model. It is in the interpretation of these analysis results that you can apply and showcase your macroeconomic skills.

This interactive visualization is based on the Federal Reserve's Issuer-to-Holder (From-Whom-to-Whom) data, which provides comprehensive information on the flow of funds between different sectors of the U.S. economy. This comprehensive dataset tracks the flow of funds between different sectors of the American economy, painting a rich picture of the financial interconnections underlying the U.S. economic system.

Looking at this graph, we can see how money and assets move between households, businesses, governments, and financial institutions like banks and investment funds. The size of each node represents the total volume of funds flowing through that particular sector. The width of the lines connecting the nodes shows the magnitude of the net flow between those sectors, while the arrow heads indicate the direction.

For example, you can see a thick line connecting the "Households" node to the "Financial Institutions" node, with an arrow pointing towards the financial sector. This suggests that on net, households are transferring a significant amount of funds to financial institutions, whether through savings, investments, or other financial transactions.

By interacting with this visualization, you can explore these flow patterns in detail, uncovering insights about where capital is being allocated, how different parts of the economy are linked, and what imbalances might be building up over time. This model-free approach allows us to let the data speak for itself, without the constraints of any particular economic theory.

Causality in Macroeconomics

Investors rely on understanding economic causality to identify macro trends that influence investment decisions. Recognizing how one economic variable affects another helps in predicting market movements and economic changes.

Time Lags as a Basis for Economic Predictions

Predictive Power of Time Lags: The concept of time lags is central in making economic predictions possible. If today's economic outcomes are the results of past actions, it implies that current actions are shaping future outcomes. This understanding is pivotal for forecasting.

Utilizing Historical Data: By analyzing how past events have unfolded over time and their delayed effects, investors and economists can predict future market trends and economic conditions with a degree of certainty.

Strategic Planning: This knowledge enables investors to strategically plan their actions today to align with anticipated future market conditions, making time lags a critical component in economic forecasting.

Academic Perspective on Economic Forecasting

Research and Analysis: Academia contributes through extensive research and econometric modeling, providing deeper insights into economic causality. This research helps investors understand complex market dynamics and future trends.

Educated Investment Decisions: Armed with academic findings, investors can make more informed decisions, aligning their portfolios with well-researched economic forecasts.

Case Studies

Explore detailed economic case studies that demonstrate the practical application of causality analysis:

→ View comprehensive user guide

The Z1 report - the good starting point to explore the causality in economics

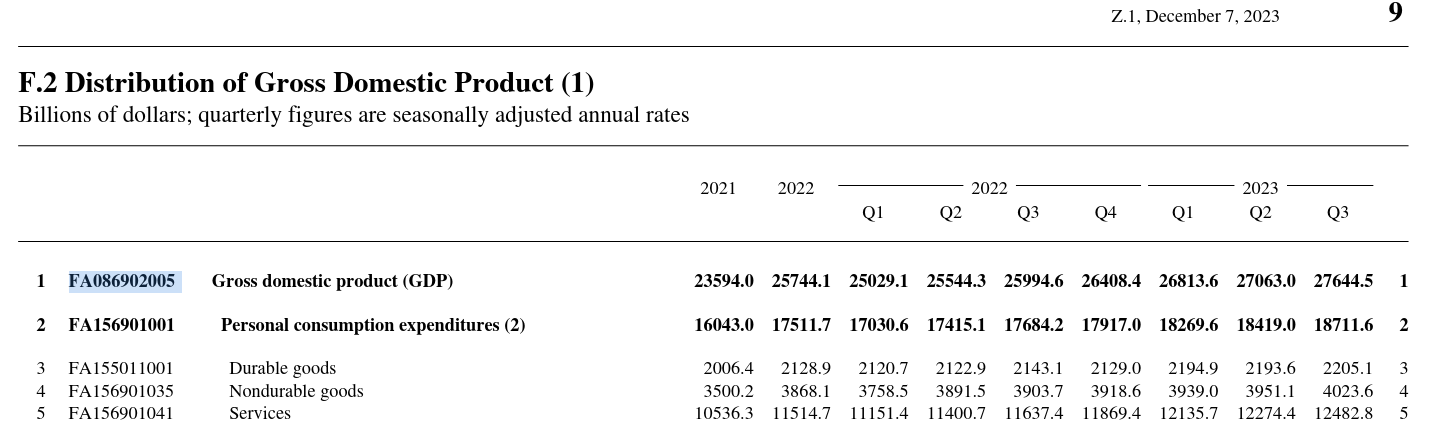

The Z1 report, often referred to as the "Financial Accounts of the United States" is an extensive publication by the Federal Reserve that features thousands of time series data going back to 1947. This comprehensive report offers in-depth insights into various aspects of the U.S. financial system, including detailed information on household and non-profit organization balance sheets, financial assets and liabilities, corporate finance, government finance, and flow of funds among different sectors of the economy. Its historical depth and breadth make it an invaluable resource for understanding long-term economic trends and financial dynamics in the United States.

Let's Start Mining the Z1 Report

Please enter any code from the Z1 report (for example, FA086902005 for the US GDP) into the box below. Then, wait for 2 minutes while on-the-fly calculations are performed. This will provide you with initial insights into identifying which time series influences which, and determining the associated time lags within the US economy.